Business Made Simple

with Info-Tech HRMS software

Info-Tech delivers Award Winning Saas Cloud HRMS software and helps you reach your business goals. Integrated together, we make managing business easy and simple for you.

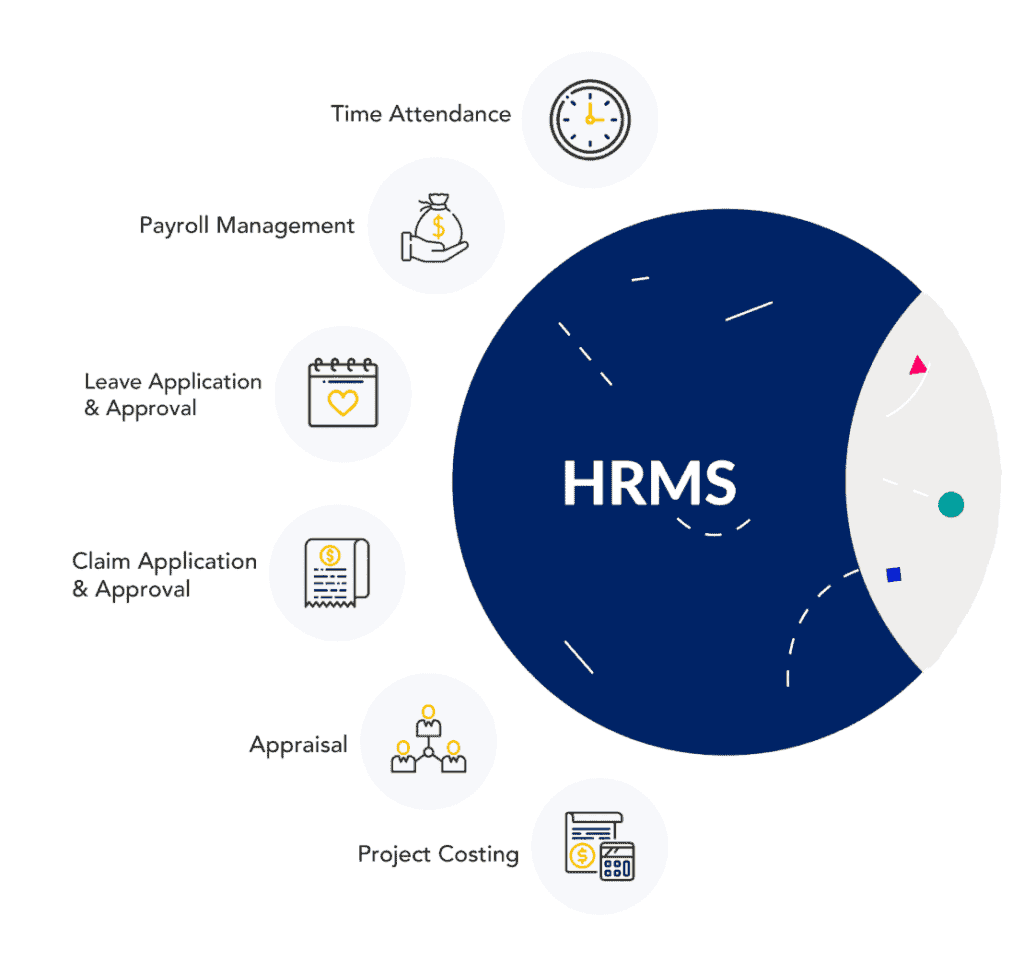

Here’s what your business will love - HRMS All-in-one Software

The first mobile app in Singapore with complete HRMS & Payroll Software From Just

$2 Per Month*

InfoTech FAQ

InfoTech founded in 1996, is a next-generation global technology company that helps businesses of all sizes and in all industries to transform their HR operations into the digital age that will propel their productivity growth to a new level.

1. 26 years of experience in the HR industry

2. The first in the HR industry to obtain the DATA Protection Trustmark certificate by IMDA

3. ISO 27001 certified

4. Dedicated after-sale support personnel for your clients

5. A very comprehensive HR software that can cater to most industries

PSG Grant Eligibility:

1. Registered and operating in Sg;

2. Have min 30% local shareholding; AND

3. Company's Group annual sales turnover not more than S$100 million; OR

4. Company's Group employment size not more than 200 workers

SFEC Grant Eligibility (up to 90% out-of-pocket-expenses):

1. Total combined contributed SDL (Skills Development Levy Funds) of all Company's employees, is at least $750 or higher, for the period between 01 Jan 2020 to 31 Dec 2020.

2. At least have min 3 employees who are Singapore Citizens or PRs in each and every month between 01 Jan 2020 to 31 Dec 2020.

3. Have not been qualified at any of the earlier periods.